ING News: Among Europeans, Luxembourgers appear to be the biggest “fans” of personal loans

The last ING International Survey is full of information on credits, very interesting in this period of Autofestival.

It reveals for example that Luxembourg residents are more likely to take out a personal loan (the biggest score among Europeans with 35.4 % compared to 22% for the European average)than to use their credit card, overdraft on their account or to ask their family or friends for help. 44.3% of the people surveyed in Luxembourg declare they absolutely have no personal debt.

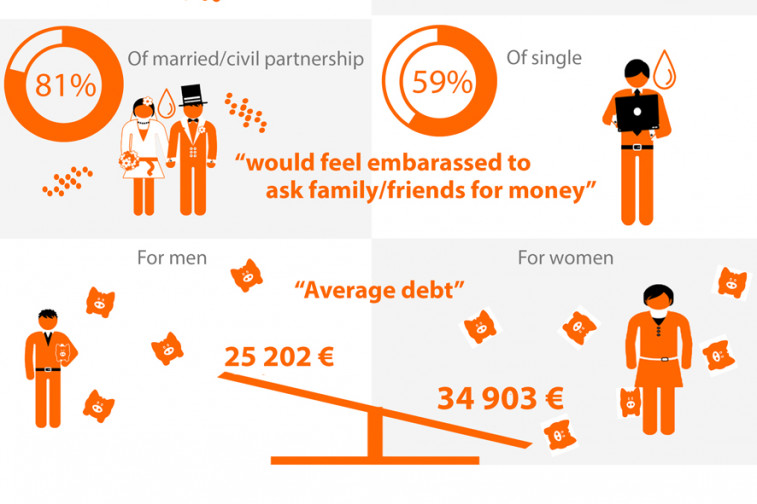

Married couples are the biggest fans of personal loans with 41,8% but they are more reluctant than singles to ask for assistance from their family (81% would be embarrassed to do so, compared to 29% for singles). Moreover, Luxembourgers are much more likely to take out a personal loan than foreign residents (40,6% against 26,5% respectively).

As far as interest rates are concerned, there are more Luxembourg residents who know the rate on their savings account (78.8%) than the one paid on their loans

(73.8%). This is close to the European average with 81% and 73,3% respectively. However, when they are asked whether they know which bank offers the best rate on savings accounts, 40.4% answer that it is not interesting to save money on such an account, given the present level of interest rates.

As far as borrowed amounts are concerned, these are bigger in the Grand-Duchy (average of 29,161€ for a personal loan) than in any other country (average of 7,959€ in Europe). Luxembourg residents are far ahead from their Austrian neighbors who rank in second position with 15,609€.

Within the Grand-Duchy itself, the survey reveals the average amount of personal loans rises with the level of education: residents having at least university education have debts of 39,961€ on average. The average amount is also higher for residents with Luxembourg nationality (35,962€) than for foreign residents (13,637€). Women stand out with an average amount of personal loan 10 000€ higher than that of men (34,903€ versus 25,202€). Finally, a last difference has been observed between age categories. Residents aged from 25 to 34 years are the most indebted with an average amount of personal loan equal to 45,295€.

When they can choose between having an overdraft on their account and using their credit card, only one third of Luxembourg residents surveyed (34.7%) prefer overdraft, against 55% for Dutch residents and 45% for the European average.

Moreover, 75% do prefer to differ a purchase instead of paying interest due to overdraft, which is close to the European average (76.8%).

More details on eZonomics.com: http://www.ezonomics.com/ing_international_survey/savings_2015

Communiqués liés

RSA launches technology and management liability insurance s...

RSA Luxembourg, part of Intact Insurance Specialty Solutions, today announces th...

Lancement d'une nouvelle connexion intermodale entre Bettemb...

CFL multimodal a le plaisir d'annoncer le lancement de sa nouvelle connexion i...

Experts from LUNEX award first micro-credentials in Rwanda o...

The Rwanda Ministry of Education (MINEDUC) formally inaugurated Syllabi, a publi...

ERG Notes that ENRC Secures Landmark Victory as Court of App...

Eurasian Resources Group (ERG), a leading diversified natural resources group he...

LetzToken et La Vie est Belle annoncent leur partenariat ouv...

«?LetzToken?», plateforme de tokenisation pionnière basée à Luxembourg, et ...

ERG announces a Pre-Export Finance Facility Agreement based ...

Eurasian Resources Group (“ERG”, “The Group”), a leading diversified nat...

Il n'y a aucun résultat pour votre recherche