Armacell H1 2017 Results

Strong operating performance across all business units. Revenues increase by 13.7%; Adjusted EBITDA up by 9.0%. Transactions in Q1 2017 accelerating growth.

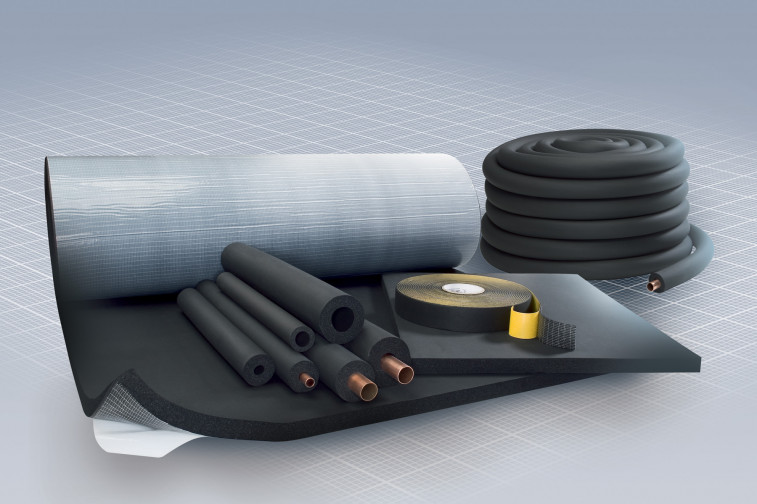

Armacell, a global leader in flexible foam for the equipment insulation market and a leading provider of engineered foams, announced its H1 2017 results on 10 August 2017.

For the six months ended 30 June 2017, net sales were up by 13.7% to EUR 313.8 million (H1 2016: EUR 276.0 million). The revenue growth was driven by all business segments. During H1 2017, adjusted EBITDA was EUR 51.3 million, up by 9.0% (H1 2016: EUR 47.1 million).

Adjusted EBITA rose to EUR 41.5 million (H1 2016: EUR 38.5 million). This positive development was driven by both business divisions and all regions despite a volatile macroeconomic environment, ongoing geopolitical tensions, and an increase of raw material costs. Commenting on the company’s financial performance, Patrick Mathieu, President & CEO of the Armacell Group, said: “We are executing our 3-year business plan and the strong performance in the first half of 2017 once again confirmed Armacell’s product portfolio and growth strategy.”

In early 2017, the PET manufacturing footprint was expanded with a new production line in Brampton, Canada, to serve the North American markets. Based on the strong demand in Asia, Armacell is now reviewing options to expand its PET foam production to China. In South Korea, a new certificate granting the company access to public projects will continue to strengthen the growth across the region.

Armacell continued to deliver on its global M&A strategy by acquiring the insulation business of Nomaco, a leading US manufacturer of extruded polyethylene insulation foams, as well as Danmat Iso Systems, a leading provider of integrated cladding solutions in Scandinavia. “The integration of our recently acquired businesses is on track and we are certain that our M&A activity will continue to drive significant synergies into the year and beyond 2017”, said Norman Rafael, Armacell’s Vice President of Corporate Development and Investor Relations.

At the end of March 2017, Armacell successfully completed its second debt repricing. Together with the repricing undertaken in H2 2016, interest costs have been reduced by approximately EUR 15 million per year as compared to the LBO financing executed in February 2016.

Dr Max Padberg, CFO of the Armacell Group, commented: “The first six months of the year were characterised by strong volumes in the insulation business and the PET business, our acquisitions and productivity gains. At the same time, the Group further improved its financing structure and decreased interest costs. Sustainable financial strength is and will remain one of Armacell’s key success factors.”

Armacell is rated B (stable) by Standard & Poor’s and B3 (positive) by Moody’s.

Communiqués liés

RSA launches technology and management liability insurance s...

RSA Luxembourg, part of Intact Insurance Specialty Solutions, today announces th...

Lancement d'une nouvelle connexion intermodale entre Bettemb...

CFL multimodal a le plaisir d'annoncer le lancement de sa nouvelle connexion i...

Experts from LUNEX award first micro-credentials in Rwanda o...

The Rwanda Ministry of Education (MINEDUC) formally inaugurated Syllabi, a publi...

ERG Notes that ENRC Secures Landmark Victory as Court of App...

Eurasian Resources Group (ERG), a leading diversified natural resources group he...

LetzToken et La Vie est Belle annoncent leur partenariat ouv...

«?LetzToken?», plateforme de tokenisation pionnière basée à Luxembourg, et ...

ERG announces a Pre-Export Finance Facility Agreement based ...

Eurasian Resources Group (“ERG”, “The Group”), a leading diversified nat...

Il n'y a aucun résultat pour votre recherche